Canada Emergency Business Account is a $25 Billion Relief Fund created by Government of Canada to provide ‘Access to Credit’ to the struggling Businesses and Not-for-Profits in order to support them with cash flow as a part of Canada’s Covid-19 Economic Relief Plan.

Canada Emergency Business Account provides an Interest-Free Loan of $40,000 to qualifying Small & Medium-Sized Businesses.

“Aims to Position the Economy to Recover.”

Who Qualifies?

Canadian-Operated Businesses that have Federal Tax Registration and Payroll Spend in the year 2019 is between $20,000 – $1.5 Million are eligible for CEBA.

How much you Qualify for?

Once you submit, it will be reviewed for eligibility and submitted to the Federal Government for funding. Upon approval, you’ll receive a confirmation email from your bank, and the $40,000 loan will be credited into your existing Business Operating Account.

How can you apply?

Business owners can apply for Financial Support from the CEBA through their Banks and Credit Unions.

Links to 6 Major Banks:

- BMO BANK OF MONTREAL

https://www.bmo.com/small-business/financial-relief-loc/#/login?PID=MBLBC&language=en

What you need to apply?

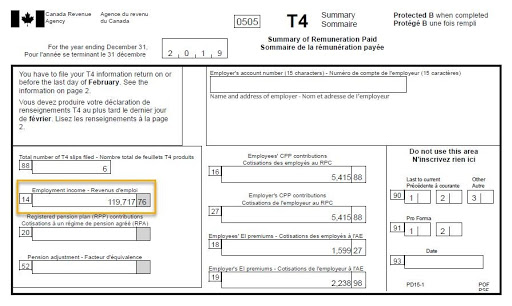

Application process is simple. You will need copy of your 2019 T4 Summary return and enter CRA Payroll Account number and amount from Box 14 in the application form.

What are the repayment terms? Is part of the loan waived?

CEBA loans are backed by the Government of Canada, and up to $10,000 of that amount will be eligible for complete waiver if $30,000 is fully repaid on or before December 31, 2022. For those unable to repay at that time, the loan can be converted into a Three-Year Term Loan at an interest rate of five per cent.

What CEBA is not for?

The Borrower shall only use the funds from this loan for Paying Non-Deferrable Operating Expenses like:

- Payroll of the Employees

- Rent of the Business

- Utilities Expenses

- Insurance Premiums

- Property Tax

- Regularly Scheduled Debt Service

The loan may not be used to fund any Payments or expenses such as Prepayment/Refinancing of Existing Indebtedness, Payments of Dividends, Distributions and Increases in Management Compensation.