What is Construction Mortgage?

Construction Mortgage as the name goes is a type of mortgage that allows you to finance the construction of your home. The concept is that it allows you to finance the purchase of a home that may not even exist yet – whether you are designing it or purchasing a pre-build in a development project.

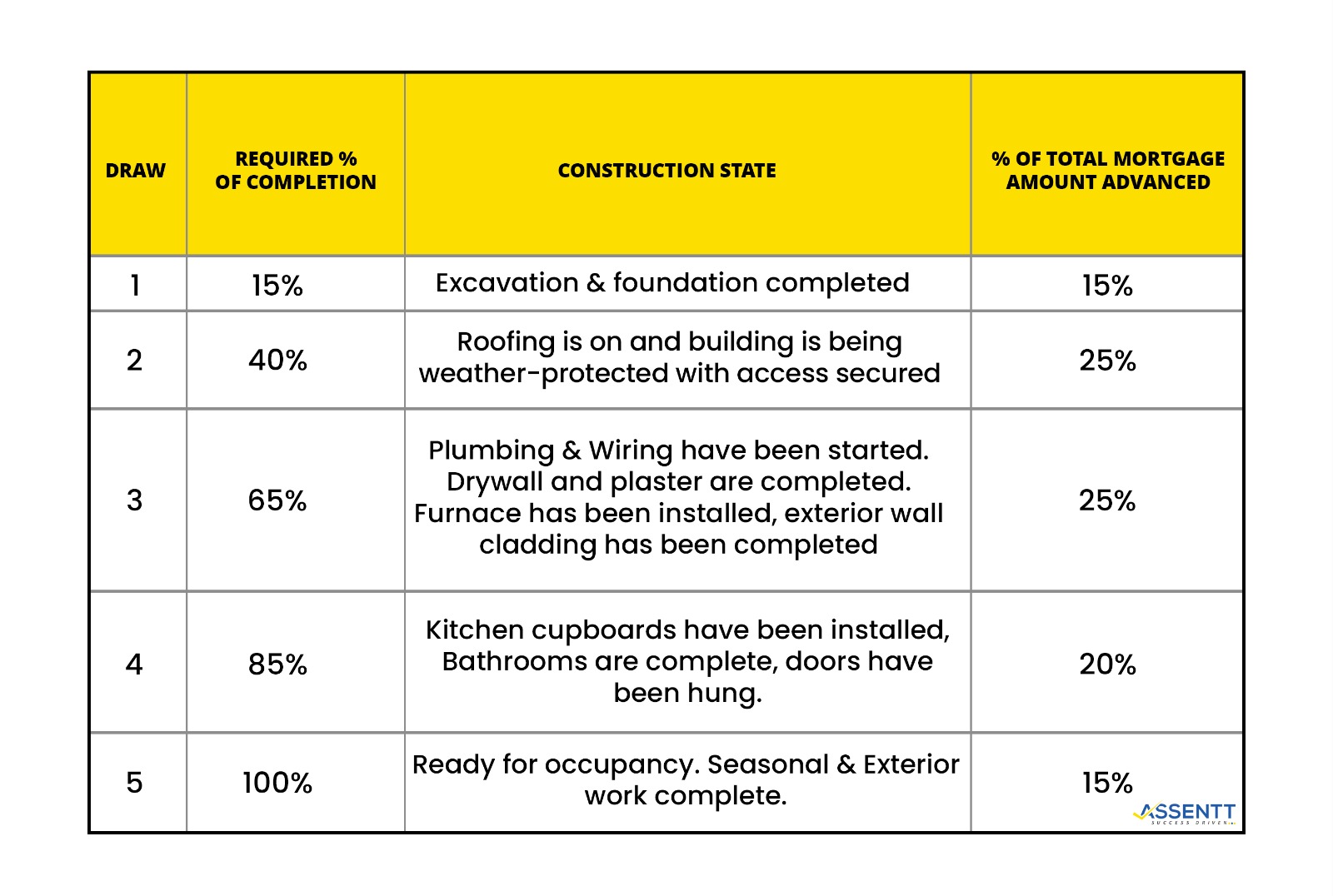

Construction mortgage is also commonly referred as builder’s mortgage in Canada. Unlike traditional mortgage where funds are paid in a single payment to the seller on the closing day, here you are paid out in smaller increments (referred as draw) as each phase of construction is completed. That is, as the construction keeps proceeding, the funds keep getting released.

This kind of mortgage is most common with people who already have a plot of land and looking to build on it their dream house.

How Construction Mortgage Works :

If you are planning to build your home from scratch on an already purchased plot or planning to buy one then Construction Mortgage is the ultimate financing solution. If you already have a plot of land then first advance is available as equity take-out and if you haven’t yet bought a piece of land then it assists you with the purchase of a vacant lot.

Construction mortgage like most loans requires a down payment. They come in fixed or variable-rate options with the possibility (in some cases) of converting to a traditional mortgage once construction is complete and certificate of occupancy is received.

Construction Mortgage requires inspections each step before the next draw is approved. The borrower owes the inspection costs which may be deductible from each draw. Till the construction isn’t complete, some lenders may require you to pay interest on the amount borrowed and once construction is complete, you are required to make payments of both principal and interest.

Draw Schedules for a Construction Mortgage :

Challenges in Securing a Construction Mortgage :

Construction mortgages are not as readily accessible as traditional mortgages as they aren’t high in demand. Thus these are hard to get and are more complicated as they require multiple inspection checks in the construction.

Further, prior to each draw being advanced, an inspector will go to the property to ensure the builder is following the NHW (New Home Warranty) policies and to ensure each stage is completed with accuracy before releasing funds.

Due to the higher risk associated with construction mortgages, approval may require the availability of larger down payment up to 30% of the total amount, meeting stricter criteria beyond the typical minimum credit score and dependable income needed for a traditional mortgage.

Lenders must also be confident in the timely completion of the project, as well as the licensure and track record of the builders in delivering quality homes, among other considerations.

Therefore, it is highly advisable to seek the expertise of a mortgage broker or bank familiar with this type of mortgage to help navigate the complexities and clarify each step involved.