Personal Tax Guide 2024

Canada’s personal tax filing process is an annual requirement for residents to report their income and claim deductions or credits. The Canada Revenue Agency (CRA) oversees this process, setting deadlines for submission and providing guidelines for accurate reporting.

Understanding your tax obligations, including types of income such as employment, investments, and rental income, is crucial in ensuring compliance with tax laws. Additionally, knowing which deductions and credits you are eligible for can help minimize your tax liability.

By staying informed about changes in tax regulations individuals can navigate the personal tax filing process efficiently and accurately. Read our Personal Tax Guide for all the tax-related information and should you have any questions, feel free to reach our office.

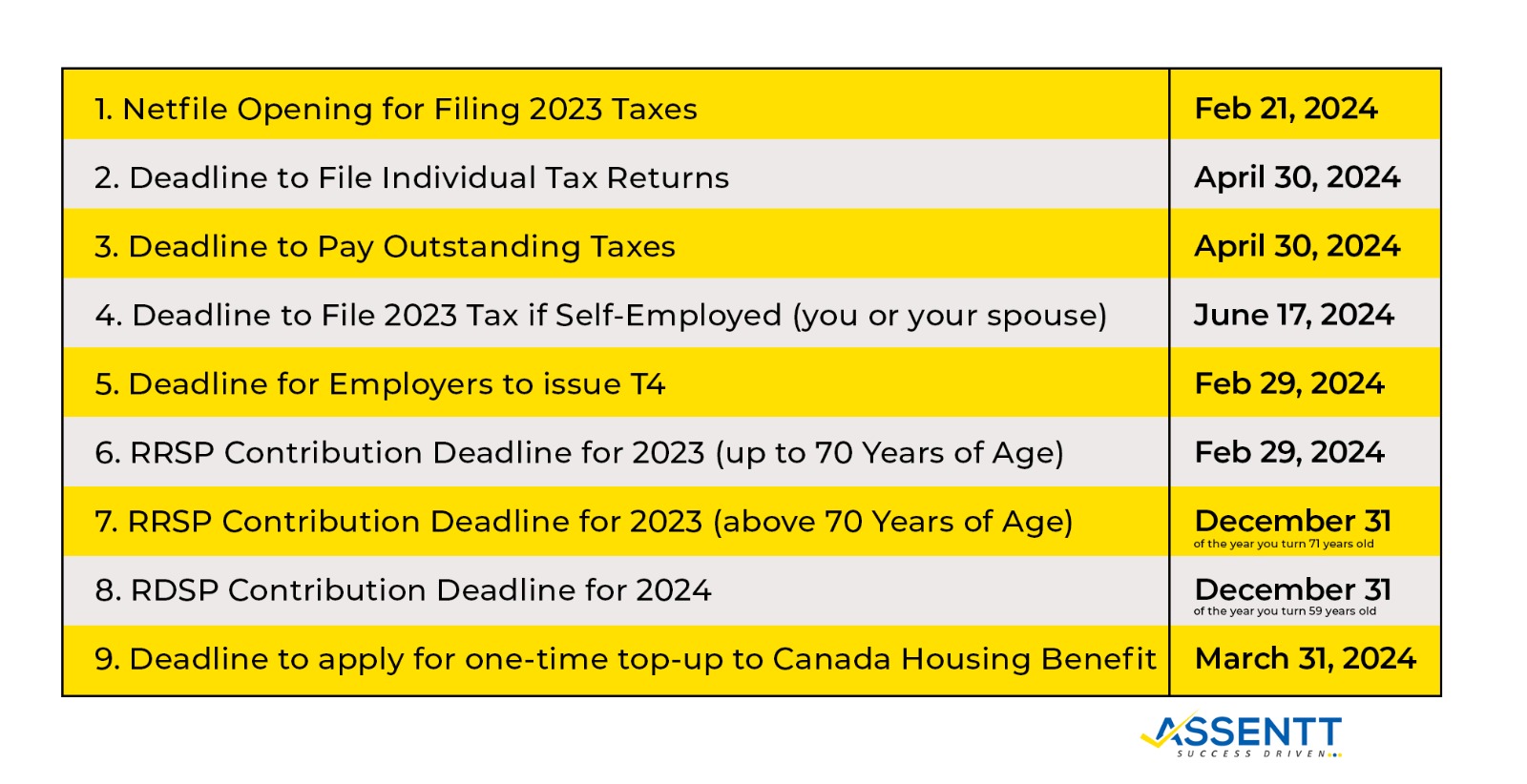

What are T Slips, when are T4s due, Tax Deadline and other important dates

- T-slips are information slips submitted to CRA by employers and institutions. T-Slips include the following:-

- T4 (employment income)

- T4A (self-employment/pension/annuity income)

- T5013 (partnership income)

- T4A-P (Canada Pension Plan)

- T4E (employment insurance benefits)

- T3, T5, T5008 (interest, dividends, capital gains)

- T4A-OAS (Old Age Security)

- T4RSP (RRSP income)

- T4RIF (RRIF income);

- Other forms that you can use to summarize income and expenses for your taxes:

- T2125 (statement of business or professional activities)

- T776 (rental income and expenses)

- T2200/T2200S (employment expenses)

- Other income details, such as tips

- Receipts for the following: Registered Retirement Savings Plan (RRSP) contributions, School-related costs and income, Childcare, Medical expenses, Charitable donations, Home buying expenses, Sale of assets and more

Penalties if you miss the deadline

Failure to meet the tax deadline will result in interest charges on the unpaid taxes. The current late-payment interest rate for taxes is 7%. Additionally, there is a late-filing penalty of 5% of the balance owed, and an additional 1% will be added for each full month the payment is late, to a maximum of 12 months. If there is a history of late filing and payment in previous years, these penalties will double to 10% and 2%, respectively.

Tax Brackets

Below is a convenient compilation of the tax brackets in Canada. By identifying your income level, you can use this information to estimate your potential tax liabilities.

- The tax rates are as follows:

- 15% on taxable income up to $50,197

- 20.5% on taxable income from $55,867 to $111,733

- 26% on taxable income from $111,733 to $173,205

- 29% on taxable income from $173,205 to $246,752

- 33% on taxable income exceeding $246,752

Which income is taxable in Canada?

Not all income is taxable, so it is important to be aware of which types of income are subject to taxation when filing taxes. Knowing the difference can prevent overpayment to the government unknowingly. Income that is taxable includes:

- Employment Income: Earnings obtained from work performed in any job.

- Self-Employment Income: Earnings acquired by offering services or selling goods as a sole proprietor or business partner.

- Interest: Income generated from funds in a bank account, GIC, or bonds. If interest income exceeds $50 in the tax year, the payer (e.g. a bank) typically provides a T5 slip for tax return purposes.

- Investments: Income derived from the sale of stocks, bonds, or investment property.

- RRSP Withdrawals: Funds obtained when withdrawing money from a Registered Retirement Savings Plan (RRSP), either in retirement or beforehand.

- Pension Income: Income received during retirement, such as payments from the Canadian Pension Plan.

Which income is not taxable in Canada?

Not all income that you receive is subject to taxation by the government. Certain earnings are considered tax-exempt, which means they do not need to be reported on your income tax return. Examples of tax-exempt income include:

- Canada child benefit and/or GST/HST credit: The Canadian government provides these benefits to help offset living costs for residents, without requesting any repayment.

- TFSA withdrawals: Withdrawals from Tax-Free Savings Accounts in Canada are not subject to tax. It is important to stay within the contribution limits to avoid facing taxation on any excess amount withdrawn.

- Educational scholarships: Money received from educational scholarships can be used to invest in a bright future without taxation implications.

- Life insurance payouts: In most cases, the money from a life insurance policy goes to the beneficiary tax-free. However, there may be circumstances where a portion of the payout goes towards taxes. It is recommended to consult with our expert team for clarification.

- Inheritances and gifts: In Canada, most inheritances and gifts are not subject to income tax. This includes birthday cash, graduation gifts, and inheritances from deceased individuals (except to cover any outstanding taxes owed by the deceased).

- Lottery and gaming: In Canada, winners of lottery and gaming activities, whether through lucky numbers or at the casino, get to keep all their winnings.

How to Reduce Income Taxes

Despite the advantages of living in Canadian society, paying taxes is still an unpopular task for many. This is why there are numerous methods available to lower income tax payments. Some of the most frequently used strategies for reducing income taxes in Canada are as follows:

- TFSA : The Tax-Free Savings Account (TFSA) allows you to earn interest on your savings without being subject to taxation. Unlike other investment accounts, any earnings generated within a TFSA are not taxed, and withdrawals also remain tax-free.

- RRSP : Utilizing a registered retirement savings plan (RRSP) is a popular method for Canadians to save money and minimize their income tax obligations. Each year, individuals can contribute up to 18% of their income or a specified amount determined by the CRA, choosing the lesser of the two options, to their RRSP. This contribution amount can then be deducted from their total income.

- Deduct Eligible Expenses : Understanding the deductions you are eligible to claim on your tax return is essential. Whether you are self-employed, working part-time, or have a side business, you can deduct necessary work expenses such as materials & supplies, marketing costs, and a portion of your phone and internet bills. As you age and work from home, claiming home office expenses can potentially reduce your taxable income.

Married and got Kids

- Child care expenses : You may be able to deduct some of your child care expenses when you file your tax return. Child care expenses must normally be claimed by the lower-income spouse.

- Spousal tax credit : You may be eligible for a non-refundable tax credit if your spouse or common-law partner has a lower income. This may reduce the amount of income tax you’ll need to pay.

- Charitable donations : You may get a non-refundable tax credit when you donate to registered charities. Consider pooling your charitable donations with your spouse or common-law partner to get a larger tax credit. To do this, one partner claims all of the couple’s donations on his or her income tax return.

- Medical expenses : You may claim medical expenses for yourself and spouse or common-law partner when you file your tax return. You may get a bigger tax credit if the partner with the lower income claims all of the medical expenses for the couple. This is because the tax credit for medical expenses is based on a percentage of your income.

- Pension income splitting : You and your spouse or common-law partner may be able to split your eligible pension income to lower the amount of tax you must pay.

Separated Couples

- Child Support : Parents who pay child support cannot claim a tax deduction for these payments. However, the person receiving support receives that amount tax-free.

- Spousal support : A lump-sum payment made on the finalization of the divorce or separation is not taxable to the recipient. But it won’t be deductible to the person paying it. However, spousal support payments are taxable to the recipient and deductible to the payer under certain circumstances. Reach out to our office to discuss in detail.

Interest payments: When to claim a tax deduction for your investments

Is it possible to deduct the interest paid on borrowed funds used for investment purposes? Yes, you can deduct the interest on a mortgage for a rental property or a loan for investments in non-registered accounts. However, there are limitations to consider.

How GICs are taxed in Canada

The tax implications of holding a GIC in Canada depend on the type of account it is held in. If you have a GIC in an RRSP account, it is tax deductible and any interest earned grows tax free. However, when you cash out the GIC in your RRSP account, you will be subject to taxation.

On the other hand, a GIC held in a tax-free savings account (TFSA) is not tax deductible in Canada. Nevertheless, the interest earned on the GIC grows tax free and no taxes are levied when you withdraw the funds. Alternatively, GICs can also be held in non-registered accounts, but any interest earned will be taxed accordingly.

Have an income property? Know exactly what you can claim

It is important to monitor expenses that are eligible for tax deductions. It is worth noting that if you or a family member resides on the property, you may only be able to claim a percentage of the expenses.

The Canada Revenue Agency (CRA) allows deductions for expenses such as interest costs, utilities, property tax, repairs, and renovations. Some expenses, referred to as current expenses, can only be deducted in the year they are incurred. On the other hand, capital expenses can be deducted in subsequent years.

Capital Gain – You can reduce your capital gains amount

A capital gain refers to the profit made from selling an asset, such as a home or real estate, with the price difference between the purchase and selling prices. Although it is not possible to completely evade the tax obligation, there are strategies available to minimize the amount of tax paid.

Home Renovations

Making home renovations can be expensive but our Government acknowledges that and tries to provide relief to the tax payers under certain scenarios.

Disclaimer – This article is for information purposes only and may not be applicable in your case. Consult our office for detailed discussion about your tax returns.