You can pay your Individual tax, Benefits and credits repayments, Part XIII – non resident withholding tax, source deductions, T2 corporation tax, or GST/HST payments to the Canada Revenue Agency (CRA) in person with cash or debit card at any Canada Post outlet across Canada for a fee. To do so you will need a self-generated quick response (QR) code. This QR code will be personalized by you and will contain information that will allow the CRA to credit your account. Canada Post uses a third party service provider to generate and process the QR code.

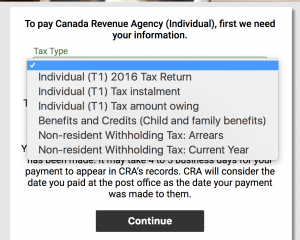

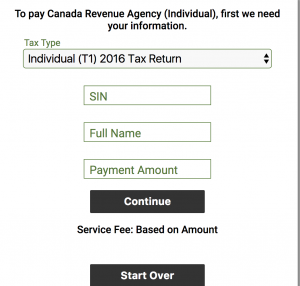

To create your QR code, click on the link below*. It is a simple two-step process. On this site you will be asked to select the tax type you want to pay, your social insurance number or account number, your name, and the amount you want to pay. A service fee will be charged based on the amount of the payment and displays when creating the QR code.

GENERATE QR CODE BY FOLLOWING THIS LINK

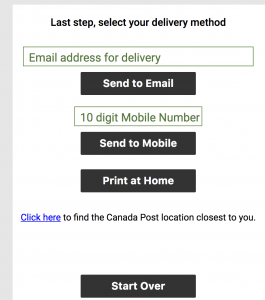

When you have completed the required fields, press ‘Continue’ to select where you want your QR code to display. The choices are: Send to Email; Send to Mobile or print at Home. You can choose any or all of these options. If you choose Send by Email, you will need to enter your email address. If you choose Send to Mobile, you will need to enter your 10-digit Mobile Number. If you choose print at home, a print icon will display.

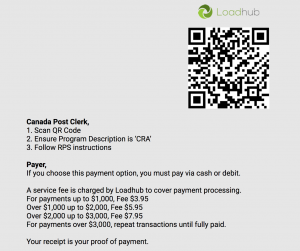

Be sure to bring your phone or printed QR code to any Canada Post outlet to make a payment. The clerk will scan your QR code and ask you how much you want to pay. The amount you initially entered is for your reference only and is not displayed to the clerk. The clerk does not see any CRA account information. The clerk will key in the amount you want to pay, add the service fee and accept payment by cash or debit card. The clerk will then give you a paper receipt with the amount paid and reference number for your files.

Source : CRA Website

Some Screenshots for your help..