U.S.A.–Canada Tariff War: August 2025 Update

The trade standoff between the United States and Canada has intensified through 2025, with both countries escalating tariffs on billions of dollars’ worth of goods. Here’s the latest status and what it means for businesses and consumers.

U.S. Tariffs on Canadian Goods

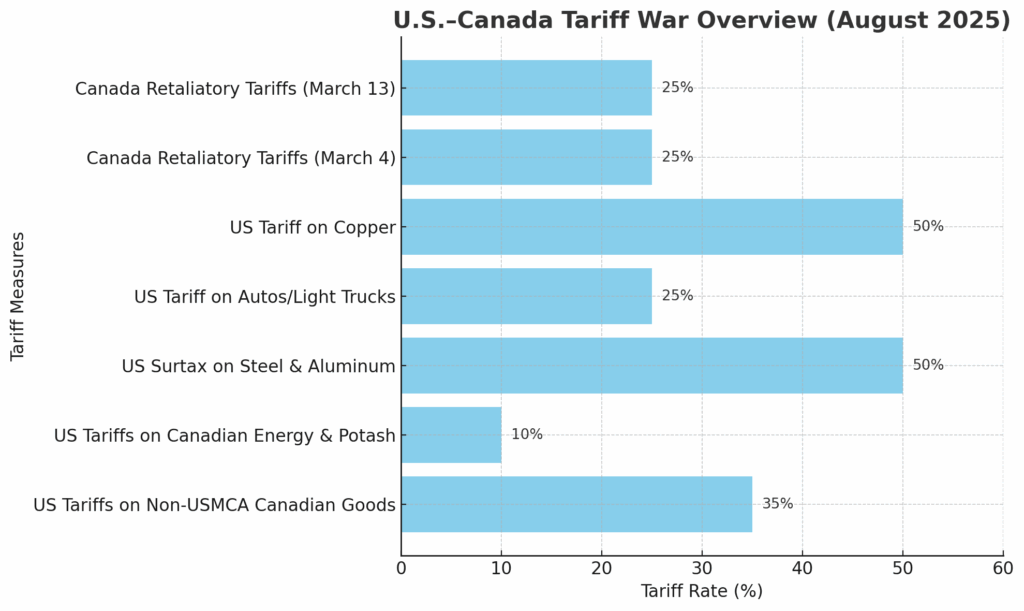

Since March 4, 2025, the United States has targeted a wide range of Canadian exports with new duties, especially products that don’t meet USMCA rules:

35% tariffs now apply to most non-USMCA Canadian goods, up from 25% earlier this year.

10% tariffs affect Canadian energy products and potash that fall outside USMCA provisions.

Steel and aluminum face a 50% surtax (effective June 4, 2025).

A 25% duty applies to automobiles and light trucks, while copper imports face 50% tariffs (both from August 1, 2025).

The de minimis exemption for low-value imports under USD 800 has been removed — starting August 29, all goods, regardless of value, will be subject to duties.

Goods that comply with USMCA origin requirements remain tariff-free. However, only about 38% of Canadian exports met these requirements in 2024.

Canada’s Retaliatory Measures

Canada has responded with sweeping tariffs of its own:

On March 4, 2025, Ottawa introduced 25% tariffs on U.S. exports worth around USD 30 billion.

Just nine days later, an additional USD 29.8 billion in U.S. goods were added to the 25% tariff list.

The federal government has indicated it could extend retaliation to cover up to CAD 155 billion in U.S. goods, although some exemptions remain for critical industries.

Impact on Trade and Travel

The tariff war is already having measurable effects:

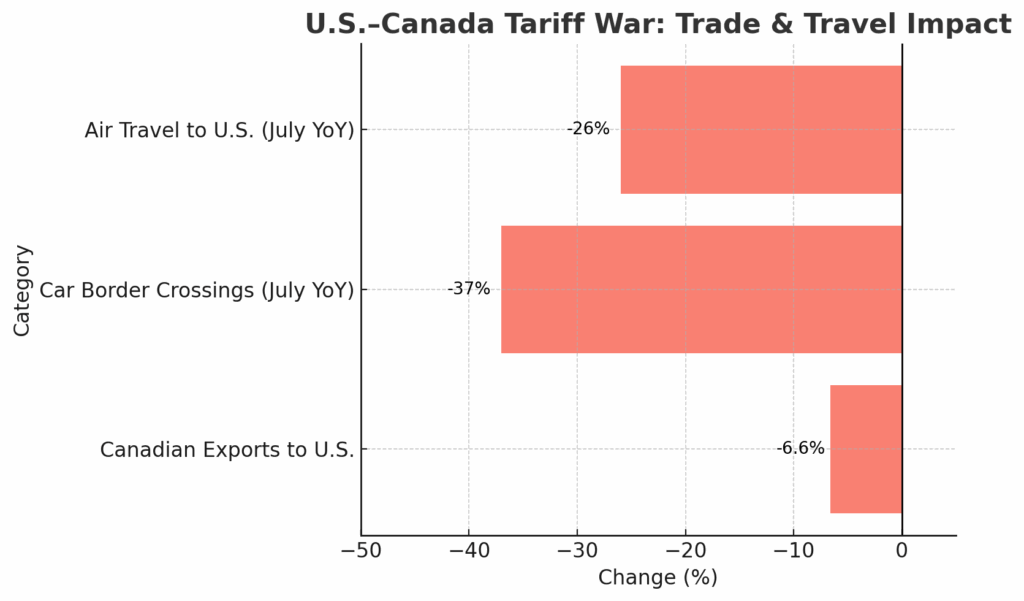

Trade: Canadian exports to the U.S. are down by roughly 6.6% compared to last year.

Travel: Canadian visits to the U.S. have fallen sharply. July saw a 37% drop in car border crossings and a 26% decline in air travel compared to July 2024.

Economic and Market Effects

- Inflation Pressures: U.S. inflation for July 2025 held at 2.7% year-over-year, but core inflation rose to 3.1%, partly due to higher import costs.

- Market Response: Despite the trade tension, U.S. markets remain strong, driven by corporate earnings. Commodity markets, such as aluminum, have seen falling premiums amid speculation about possible tariff rollbacks.

In Conclusion, the United States has significantly raised tariffs on Canadian goods that do not qualify under USMCA rules, with the impact felt across a wide range of sectors, from manufacturing to agriculture. In response, Canada has implemented extensive retaliatory measures, carefully designed to shield its most critical industries while still applying pressure on U.S. exports.

As a result of these escalating trade actions, both the volume of cross-border trade and the number of Canadians traveling to the United States have seen sharp declines. These developments are adding to inflationary pressures and causing shifts in supply chains that are expected to persist well into late 2025.

The information provided is for educational/entertainment purposes only. Actual information may vary, please consult our office for further details. Got a question? Feel free to reach us at helpdesk@assentt.com.